Recurring Plan

Updating Credit Card Details via the App

The next part may be helpful and save you valuable time if you have set that your clients will be blocked when one of their active recurring payment charges is declined. Declines can appear for a variety of reasons including stolen/blocked credit cards, maxed-out credit limits, etc. If you want your clients to update their credit card details via the client app and thus remove their block, you need to follow this order of action:

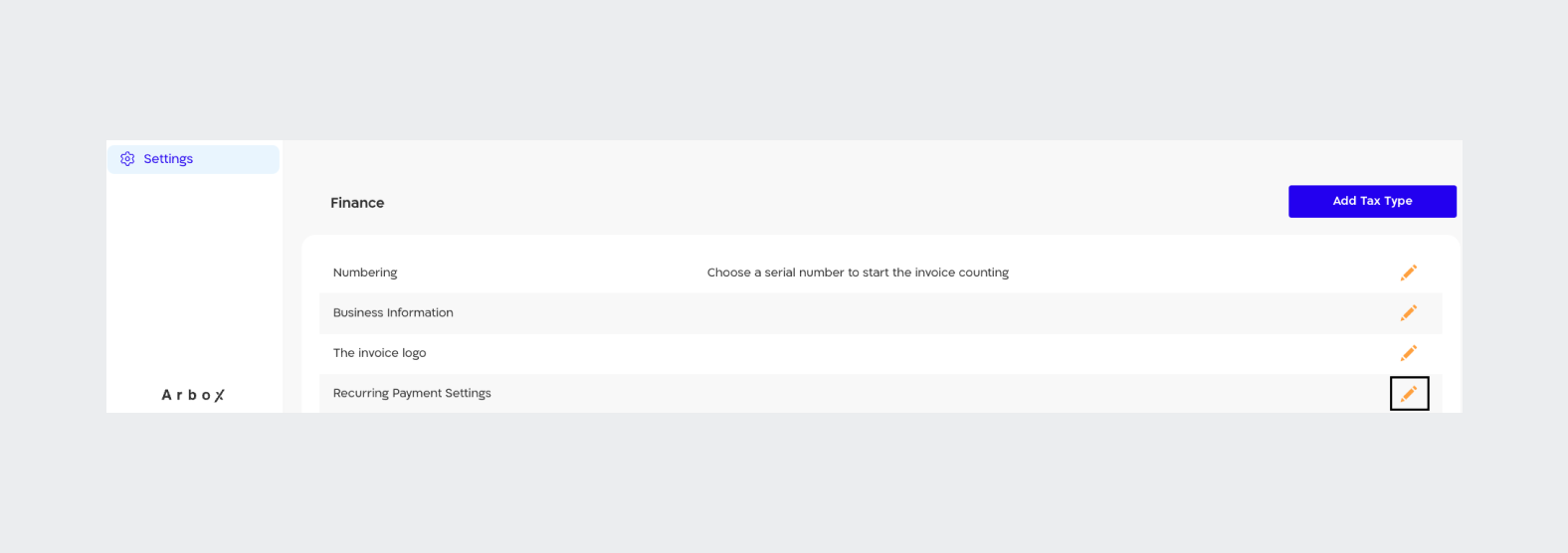

- Click on "Settings" in the main menu.

- Scroll down to the "Finance" category.

- Click the edit icon next to "Recurring Payment".

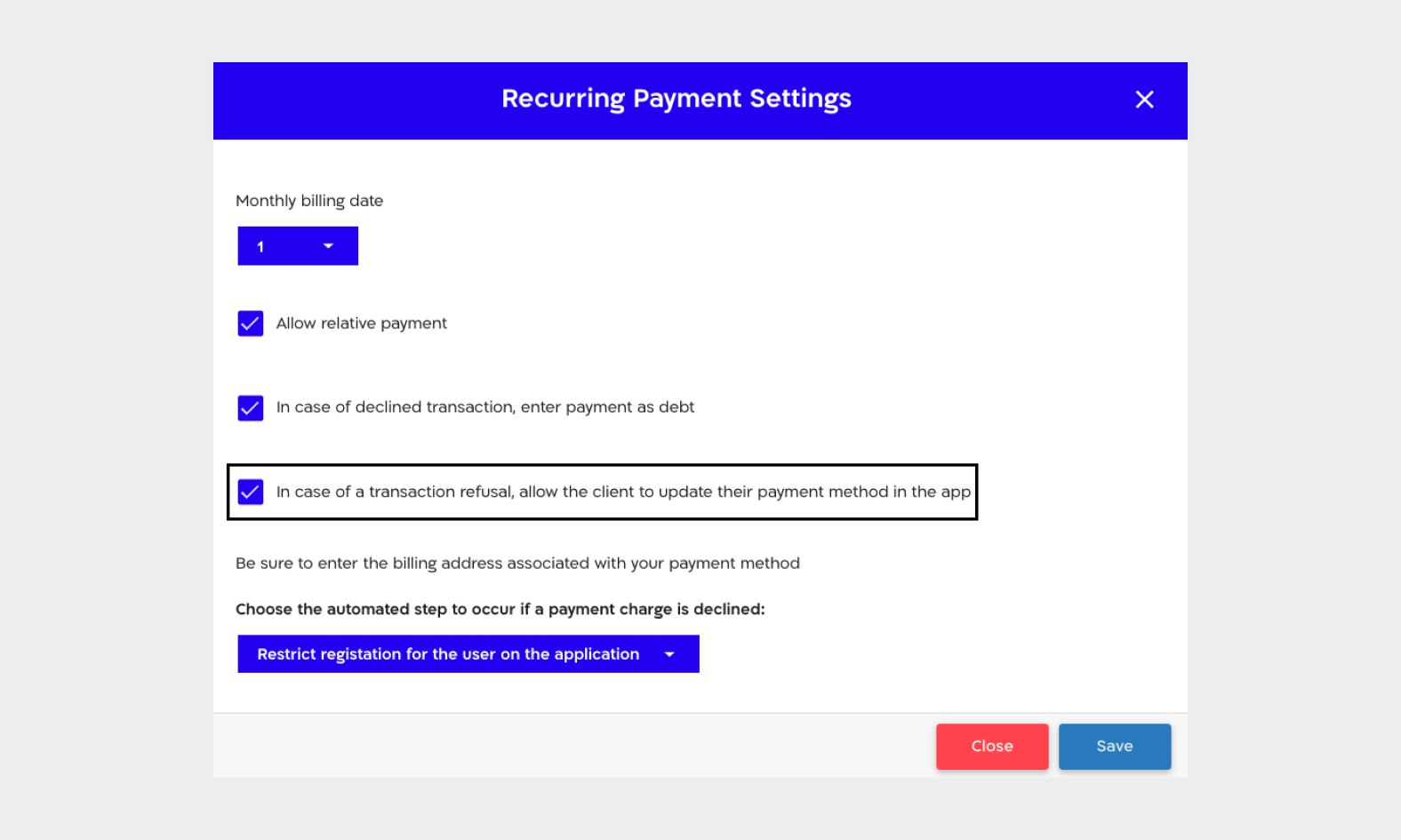

- Choose to allow clients to update their credit card via the client app, and make an "immediate payment" in order to close the debt that was created for them in the recurring payment.

- Click "Save".

We have a great tip for you! You can send pinpoint notifications to clients through 'Failed Transactions', under the 'Transactions' category. Tell them they are in debt, and that they need to update their credit card details through the client app.

.png)

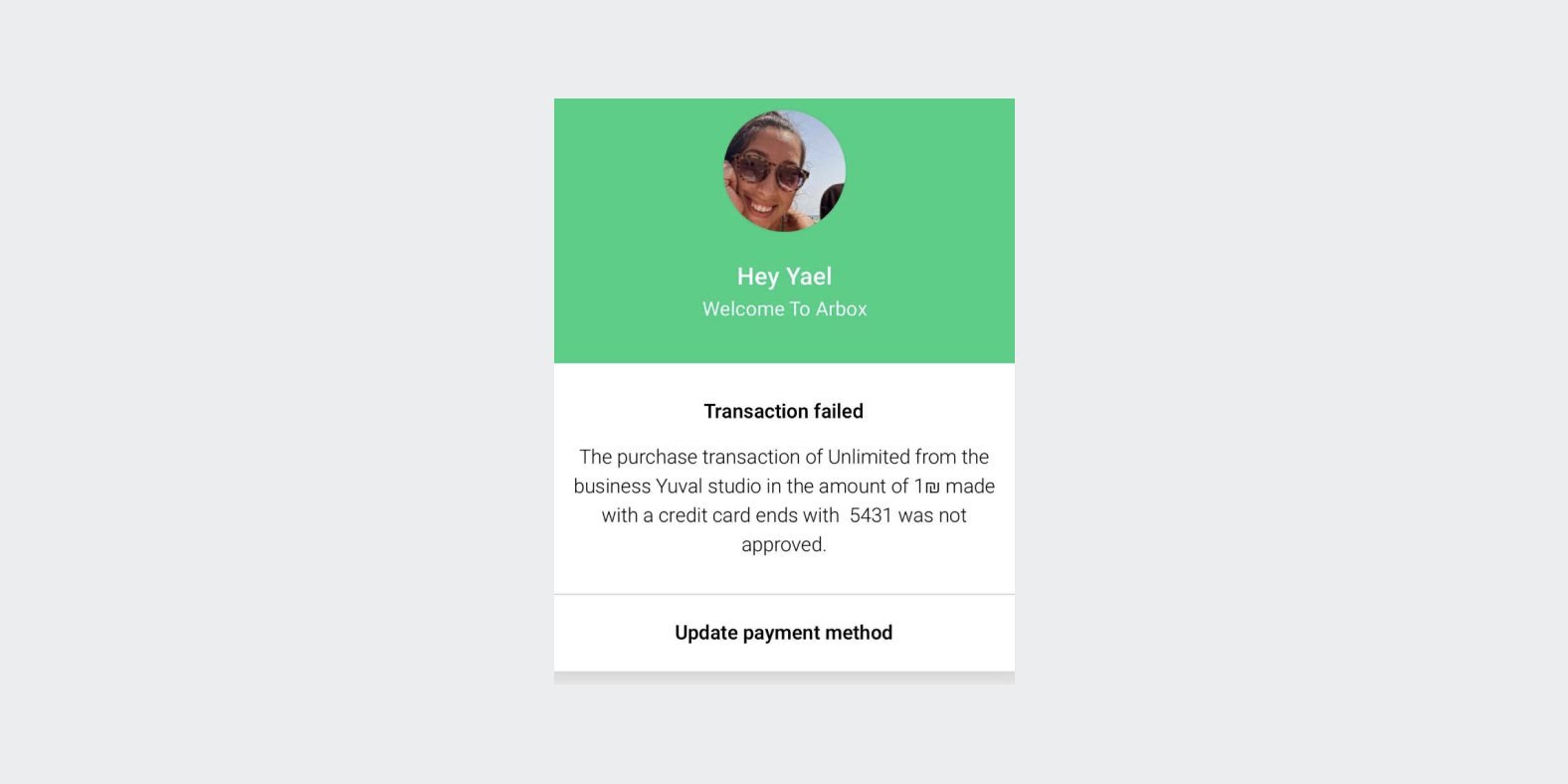

Now, we will be happy to demonstrate how updating credit card details will appear in the client app, and clarify what your clients need to do:

- Your clients will see on the app Feed a note saying "Transaction failed", they will need to press "Update Payment Method" in order to change their credit card details.

- Finally, the Update Credit Card Details screen will appear before them. They will need to press "Pay Now" in order to complete the process, and close the debt that was created for them in the recurring payment.

As soon as your clients close the debt, they will be able to go back to the schedule and register for the various events.

.svg)

.svg)

.png)

.png)

.png)

.png)

.png)